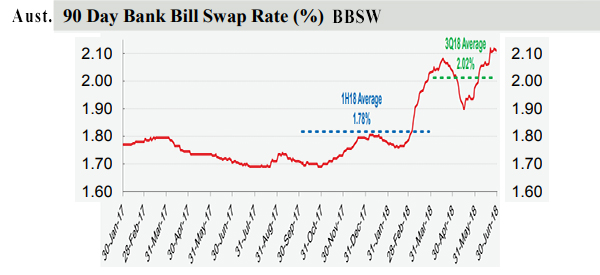

Interest rates: A term deposit offers a fixed interest rate for the life of your investment. For example, “2.50% p.a. For 3 months” or “2.99% p.a. Interest rates will usually be higher the longer the term is, as banks pay more for the certainty of re-lending your money for longer.

Best Term Deposit Interest Rates Nz

- Rabobank does not currently offer a compounding interest option for Term Deposits. The interest rates listed here are for deposits up to $5 million. For rates on deposits over $5 million please call us on 0800 22 44 33.

- Looking forward, we estimate Deposit Interest Rate in New Zealand to stand at 0.26 in 12 months time. In the long-term, the Deposit Interest Rate in New Zealand is projected to trend around 0.51 percent in 2022 and 0.76 percent in 2023, according to our econometric models.

What you need to know about Heartland Deposits

Westpac Nz Term Deposit Interest Rates

Earn a fixed rate of interest over a period of time with a term deposit, or choose a call account if you need the flexibility of adding or withdrawing from your account at any time. Open one or multiple accounts and watch your money grow while also building the Kingdom of God in Aotearoa, New Zealand. Compare term deposit rates and fees on PriceMe Money. The deposit rates are updated on a daily basis. PriceMe Money is an independent comparison service for consumers in New Zealand. PriceMe strive to provide up-to-date financial information including rates and fees, but we're not responsible for any errors or inaccuracies.

These rates are subject to change without notice. Minimum term deposit investment $1,000. Maximum $5,000,000.

Interest accrues and is payable daily in arrears on the principal amount of any unarranged overdraft on a transactional account or a savings account at Heartland Bank's prevailing interest rate for unarranged overdrafts, currently 26.70% p.a. This interest may be debited by Heartland Bank to the relevant overdrawn account and then immediately forms part of the prinicipal amount of the unarranged overdraft.

For further details about Heartland Deposits see Heartland Bank's Disclosure Statement and Product Fact Sheets that are available here or by calling 0800 85 20 20.

Savings and transactional interest rates apply to the full daily account balance and interest is credited monthly.

What you need to know about the Heartland Term and Cash PIE Fund

For details of the Heartland Term and Cash PIE Fund offer refer to the current Heartland Term and Cash PIE Fund Product Fact Sheet. Call 0800 85 20 20 or click here to obtain a copy.

Minimum investment for the Heartland Term and Cash PIE Fund is $1,000. Rates subject to change without notice.

The Heartland Term and Cash PIE Fund does not have a credit rating. Heartland Bank has a credit rating of BBB (Outlook Stable) from Fitch Ratings. Heartland Bank's credit rating is only relevant insofar as the Heartland Term and Cash PIE Fund invests in Heartland Bank. For more information on Heartland Bank's credit rating, click here.

The manager of the Heartland Term and Cash PIE Fund is Heartland PIE Fund Limited, a subsidiary of Heartland Bank.

No other person (including Heartland Bank) guarantees the obligations of the Heartland Term and Cash PIE Fund.

Rates are subject to change. Terms and conditions are available here.

I found Glimp when I was looking for Internet Providers that I would have to sit through and compare myself. I at first thought Glimp was an Internet provider but then I was pleasantly surprised when they came up as a website solely for comparing all sorts of different things so the customer could find the best deal. I found my new Internet provider on there and even found out I could be with a better Power company then the one I am with now. Very Useful and I recommend Glimp to the bargain hunters!

I found Glimp when I was looking for Internet Providers that I would have to sit through and compare myself. I at first thought Glimp was an Internet provider but then I was pleasantly surprised when they came up as a website solely for comparing all sorts of different things so the customer could find the best deal. I found my new Internet provider on there and even found out I could be with a better Power company then the one I am with now. Very Useful and I recommend Glimp to the bargain hunters!